Understanding off-payroll working (IR35) - GOV.UK

Aug 22, 2019 · Find out how to recognise tax avoidance schemes aimed at contractors and agency workers. You can get help on the off-payroll working rules (IR35) with webinars and …

IR35 - Wikipedia

IR35 is the United Kingdom 's anti-avoidance tax legislation, the intermediaries legislation contained in Chapter 8 of Income Tax (Earnings and Pensions) Act 2003.

What is IR35: Explained for Self-Employed & Contractors | Debitam

Nov 27, 2025 · What is IR35? What does inside IR35 mean? Learn how IR35 impacts self-employed contractors, with clear explanations and expert insights to stay compliant.

IR35: taxation of off-payroll workers explained - Pinsent Masons

Sep 13, 2024 · The off-payroll working rules, known as IR35, apply where a business engages an individual to provide services off-payroll and through an intermediary - commonly a company …

What is IR35? Guide to IR35 self-employed rules - Simply Business

Sep 26, 2024 · What is IR35? Many self-employed contractors find the rules confusing. Here we explain IR35's history, rules and the changes made in 2021. Read more.

IR35 Rules Explained: Everything Employers Need to Know

Jun 30, 2025 · This in-depth blog unpacks IR35 rules, requirements, and best practices to avoid penalties. You’ll learn everything you need to know about IR35 and how to keep your business …

IR35 Reforms: What Contractors and Employers Need to Know

Jun 10, 2025 · The IR35 reforms have fundamentally changed the landscape for contractors and employers in the UK. Understanding the rules, assessing status accurately, and implementing …

What is IR35, and What Does It Mean for Your Business? - Remote

Feb 5, 2025 · IR35 examines factors like control, substitution, and mutuality of obligation within the working relationship to determine if the contractor should be subject to employment taxes …

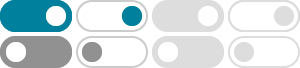

Find out from your client what your employment status for tax purposes will be. Depending on your contract and the working arrangements, your contract will either be determined to be …

What is IR35? IR35 rules explained - Contractor UK

IR35 is tax legislation that determines whether a contractor is genuinely self-employed or should be treated as an employee for tax purposes. It matters because being inside IR35 means …